There are different amortisation models for mortgages. Find out here how amortisation works, which models are available, and what the right solution is for you.

Amortisation of a mortgage – an overview

If you finance your home, the mortgage you have taken out is usually divided into a first mortgage and a second mortgage. Your second mortgage has to be amortised, i.e. repaid. The second mortgage usually has a term of 15 years. There are two types of amortisation:

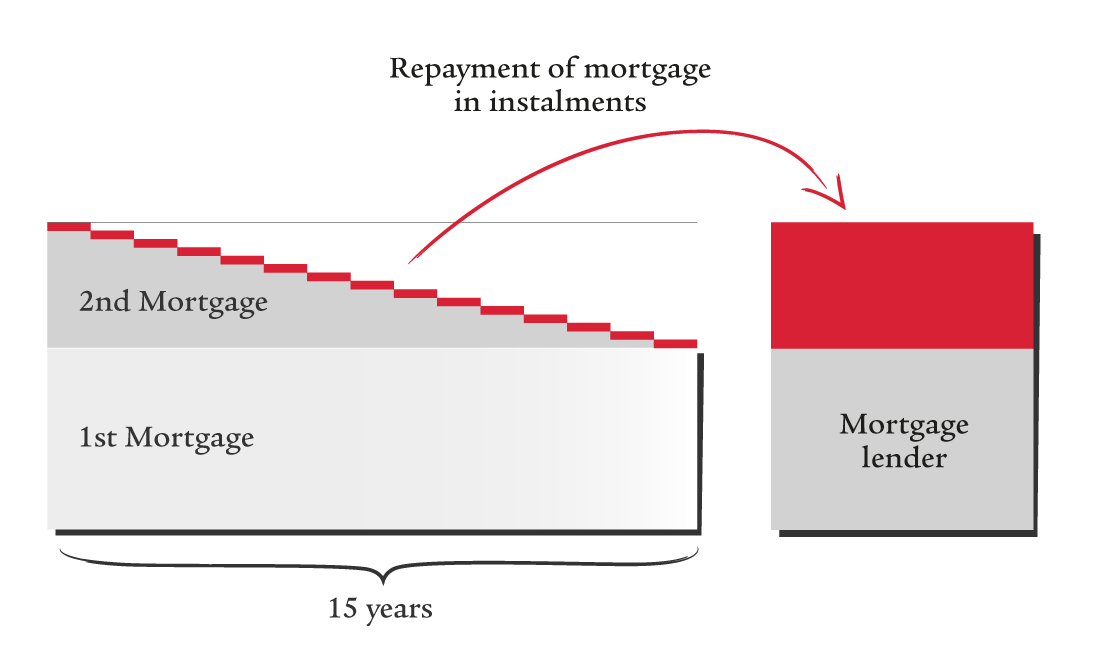

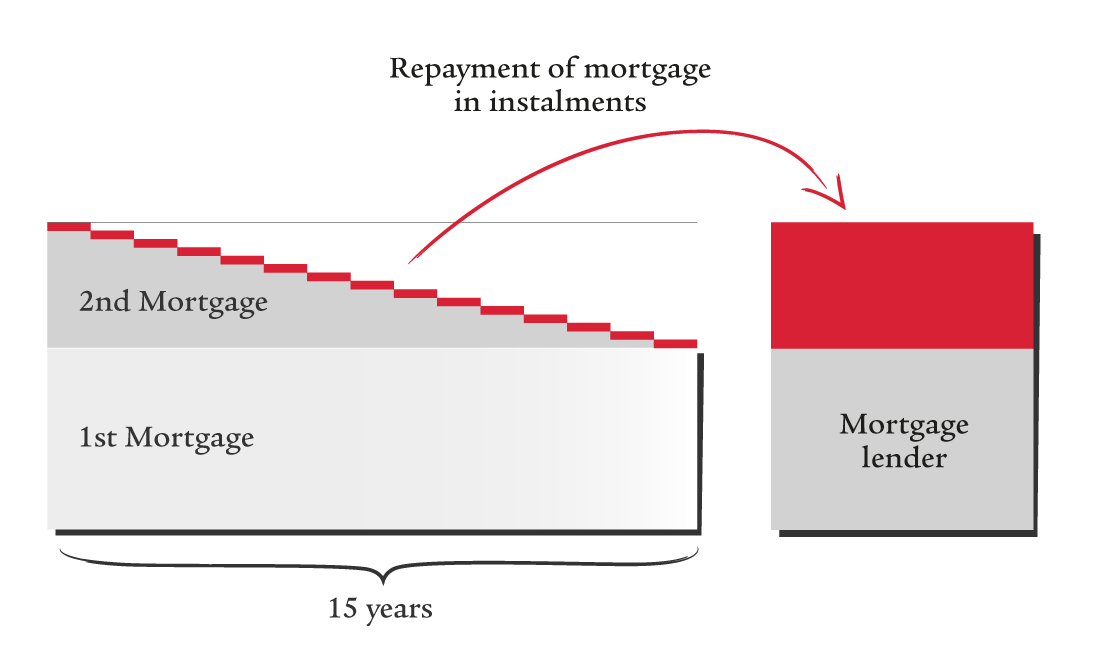

Direct amortisation

You repay the mortgage debt in regular instalments. This reduces both the mortgage and the interest burden. The disadvantage: the amount that you can deduct from your tax return will also be smaller.

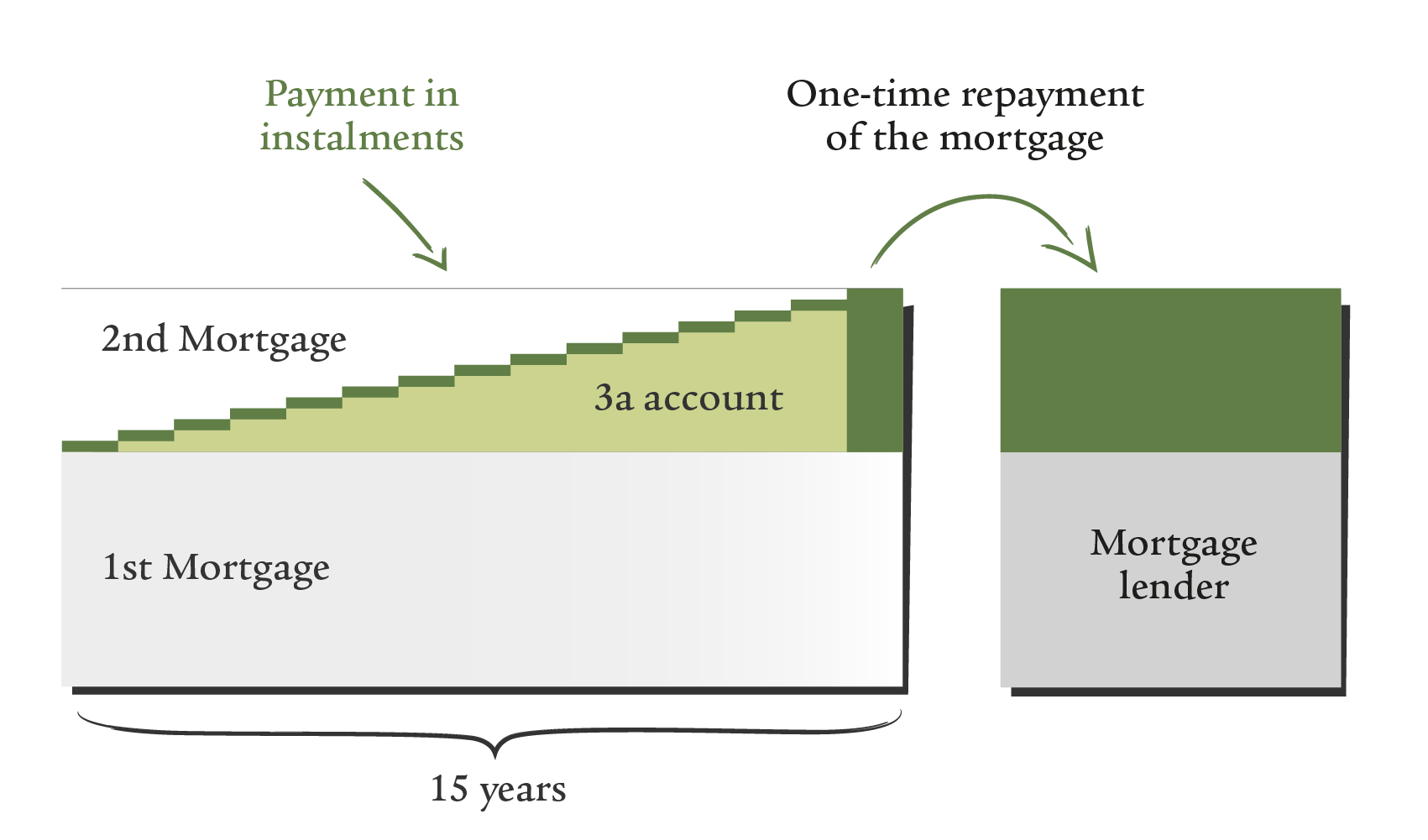

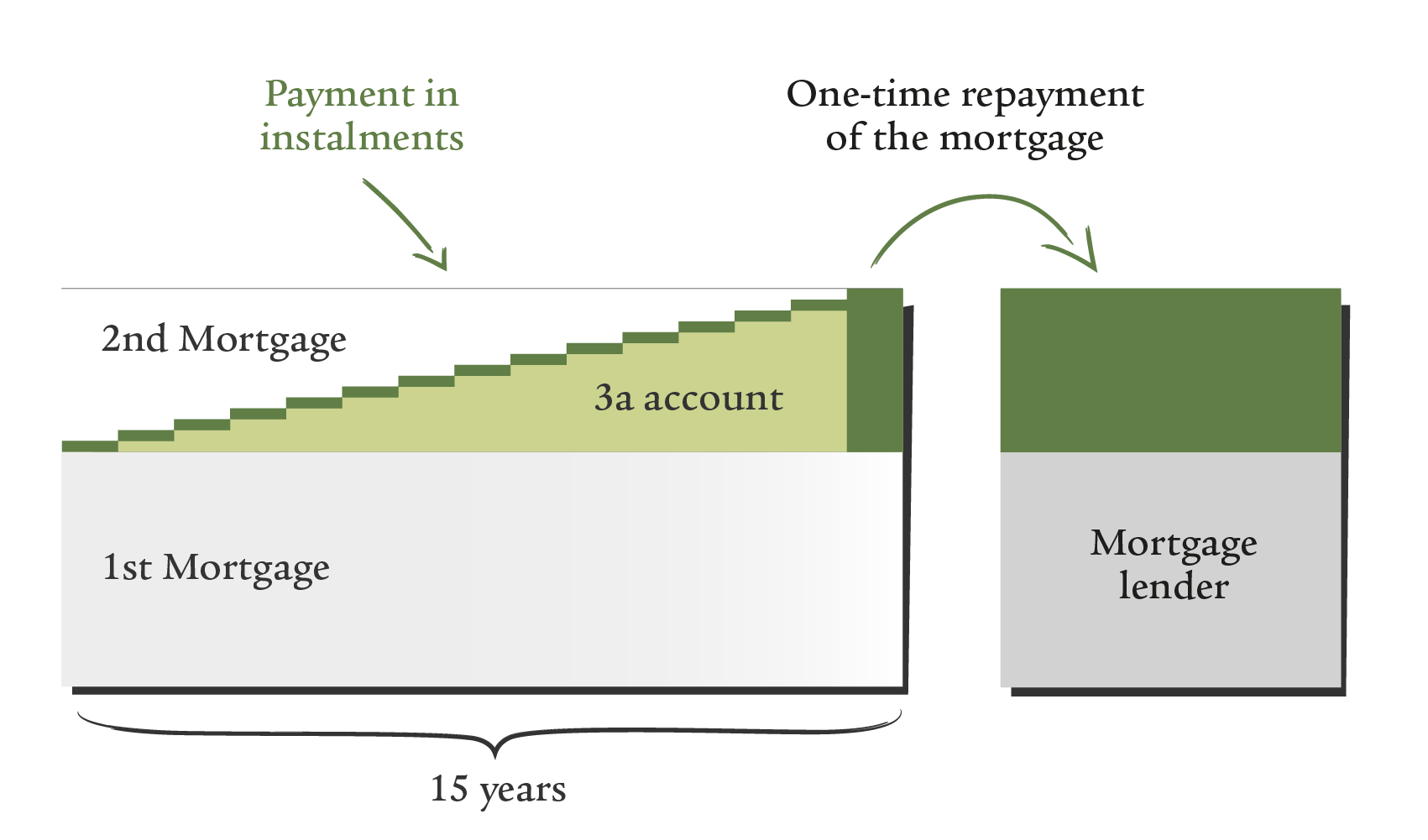

Indirect amortisation

You transfer the amortisation amount to a pillar 3a retirement savings account or invest it in a pillar 3a policy. The capital remains tied up until retirement age. You can then withdraw the money and repay the entire second mortgage in one go.

Your benefits:

- The amount that you can deduct from your tax return for mortgage interest always remains the same.

- The amount you pay into pillar 3a can also be deducted from your taxable income.

- You benefit from the returns and preferential interest rates for pillar 3a saving.

How we can support you in finding the right financing.

We advise you comprehensively on your way to the right financing and support you from the initial planning to your own four walls and beyond. This has many advantages for you:

- We take a comprehensive look at your personal situation and tailor a financing concept for you.

- Thanks to the SwissFEX mortgage platform, we can show you a wide range of offers from different providers. Suitable offers are compared transparently and in real time.

- We make it possible for you to access mortgages on preferential terms that you would not otherwise have access to.

- We determine the right amortisation model, tailored to your needs.