There will be a popular vote on the reform of occupational pension provision on 22 September 2024. The reform is intended to strengthen the financing of the 2nd pillar, maintain the overall level of benefits and improve the protection of part-time employees.

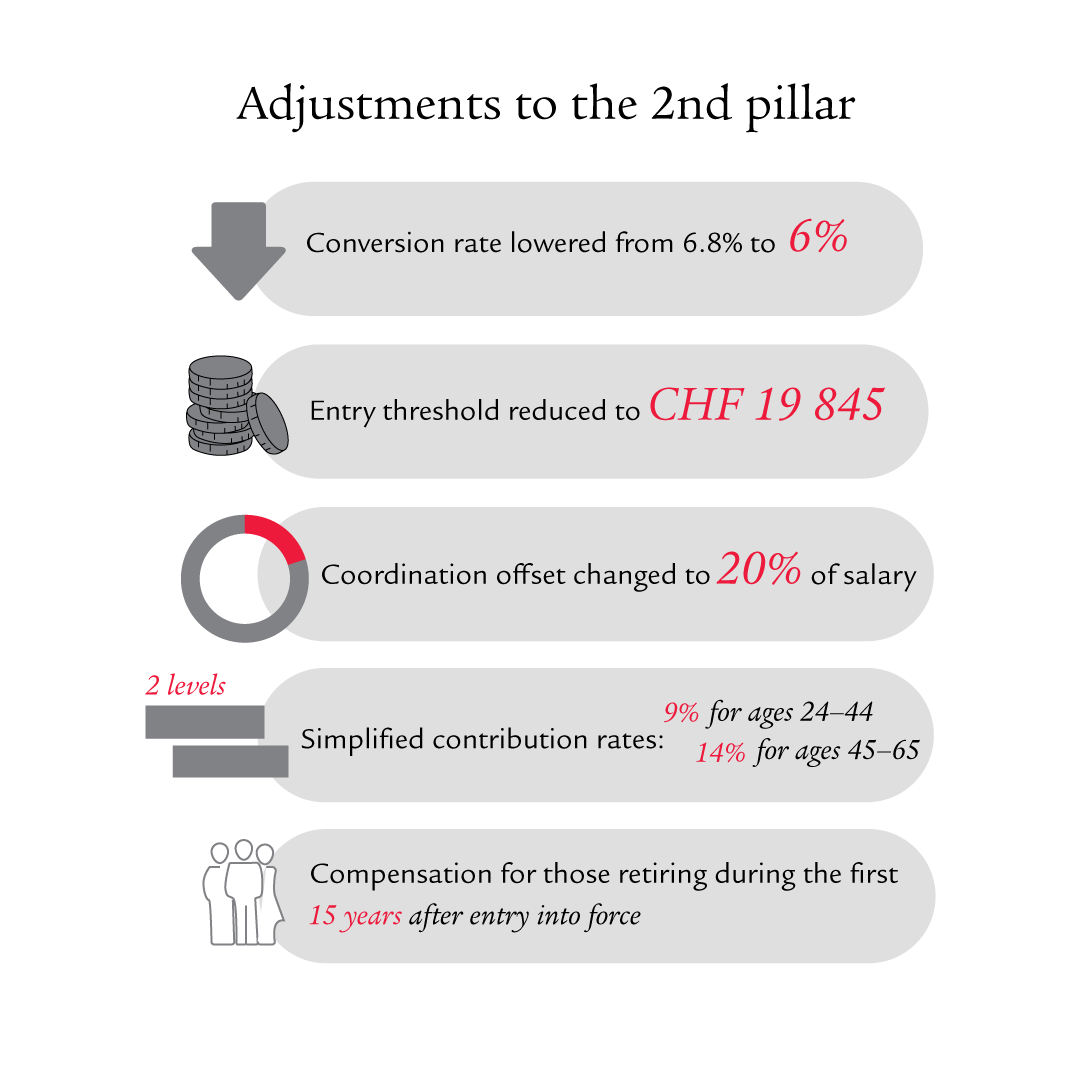

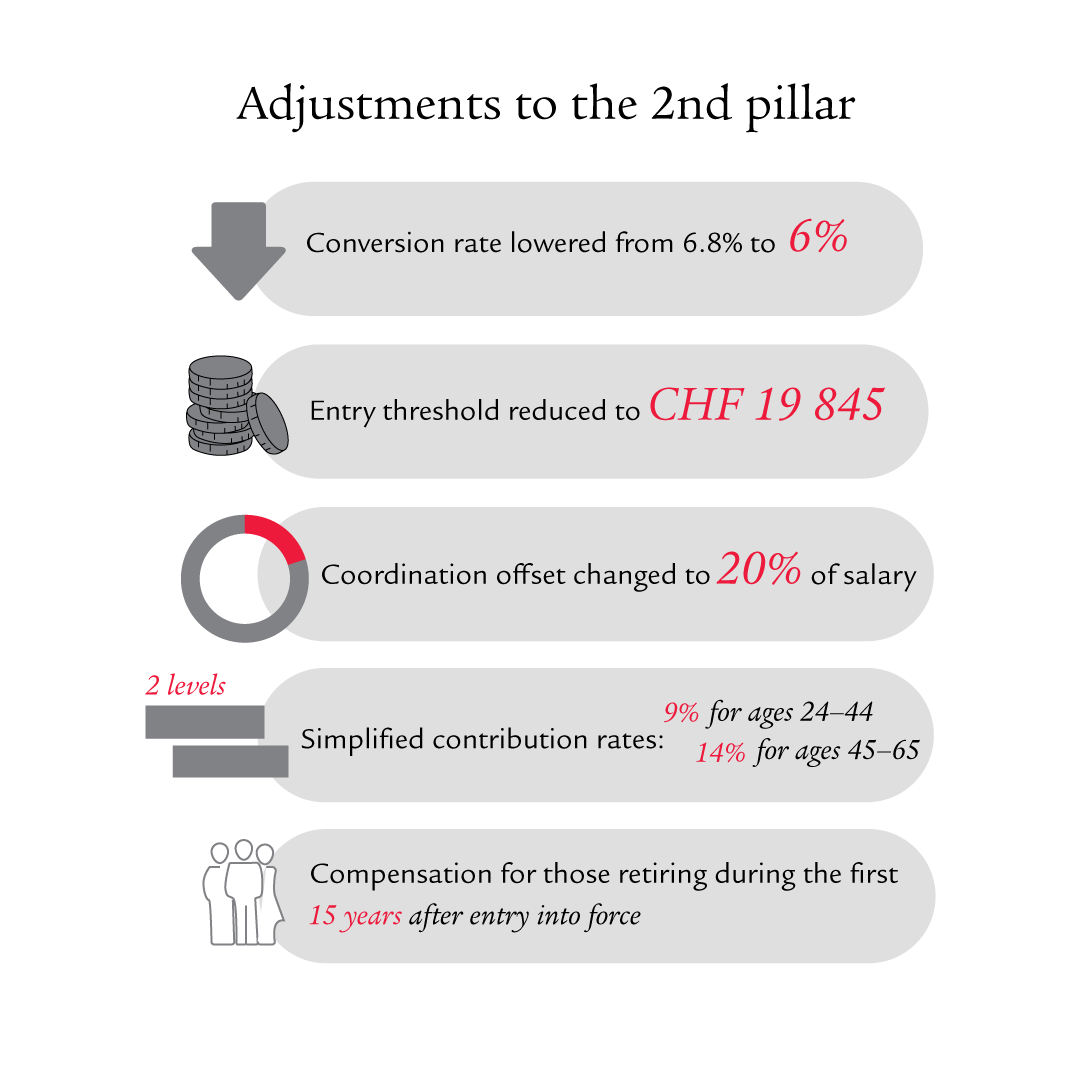

The following changes are envisaged in the BVG/LPP reform:

- Lowering the minimum conversion rate from 6.8% to 6.0%

- Lowering the entry threshold from CHF 22 050 to CHF 19 845

- Altering the coordination offset from the fixed amount of CHF 25 725 to a variable amount of 20% of the AHV/AVS salary (up to max. CHF 17 640)

- Reducing retirement credit rates from four to two, namely 9% for the 25–44 age category and 14% for the 45–65 age category (currently 7% for 25–34; 10% for 35–44; 15% for 45–54; 18% for 55–65).

- Transitional benefits for those retiring during the first 15 years after entry into force:

- Full pension supplement up to max. retirement savings of CHF 220 500.

- CHF 2400 for the first five cohorts

- CHF 1800 for the following cohorts

- CHF 1200 a year for the last five cohorts

- CHF 2400 for the first five cohorts

- Insured persons with retirement savings of CHF 220 500 to CHF 441 000 are entitled to a supplement that is reduced incrementally depending on the amount of retirement savings. For this purpose, the Federal Council will draw up a degressive scale for determining the pension supplement.

- No pension supplement for retirement savings over CHF 441 000.

- Full pension supplement up to max. retirement savings of CHF 220 500.

What are the likely medium- to long-term implications if the BVG/LPP reform is adopted?

- Tangible improvement in statutory contributions, especially for part-time employees and people working multiple jobs.

- Higher savings contributions due to stronger savings process (adjustments to the coordination offset and savings scale), especially for lower incomes.

- Around 70 000 additional insured persons under the BVG/LPP due to the lower entry threshold.

- Lower cross-subsidisation of current pensions due to lower minimum conversion rate.

- Better interest on retirement savings possible due to lower cross-subsidisation requirement.

- Short term: pension losses caused by the reduced minimum conversion rate compensated by pension supplements for 15 cohorts.

We’ll be happy to advise you.

Our experts can help you with all questions relating to your personal pension situation and show you how to close pension gaps.